Sarbanes–Oxley Act - Wikipedia

The Sarbanes–Oxley Act of 2002 is a United States federal law that mandates certain practices in financial record keeping and reporting for corporations.

What Are SOX Controls? Best Practices for SOX Compliance

May 16, 2024 · TL;DR SOX controls are essential for ensuring the accuracy and reliability of financial reporting as mandated by the Sarbanes-Oxley Act. This article explains the …

Sarbanes-Oxley Act: What It Does to Protect Investors

May 8, 2025 · The U.S. Congress passed the Sarbanes-Oxley (SOX) Act of 2002 to help protect investors from fraudulent financial reporting by corporations that cost them billions.

What is Sarbanes-Oxley (SOX) Act compliance? - IBM

SOX compliance is the act of adhering to the financial reporting, information security and auditing requirements of the Sarbanes-Oxley (SOX) Act, a US law that aims to prevent corporate fraud.

What is SOX Compliance? 2026 Requirements, Controls and More

What is the History of the SOX Act? The Sarbanes-Oxley Act was enacted in 2002 as a reaction to several major financial scandals, including Enron, Tyco International, Adelphia, Peregrine …

SOX compliance FAQ: The basics of navigating regulatory demands

Apr 25, 2024 · Section 302 of SOX states that the chief executive officer (CEO) and chief financial officer (CFO) are directly responsible for the accuracy, documentation and submission of all …

What Are SOX Controls? Types, Examples, & Best Practices

Apr 21, 2025 · SOX controls are internal mechanisms designed to ensure financial reporting accuracy, prevent fraud, and protect investors. These controls fall under the Sarbanes-Oxley …

A Complete Guide to SOX Compliance | Bitsight

Oct 31, 2025 · SOX compliance refers to adhering to the requirements set forth by the Sarbanes-Oxley Act. It mandates that companies establish robust internal controls and procedures to …

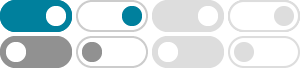

Access control essentially involves organizations controlling permissions in their financial systems and who can access and manipulate data related to financial transactions. While access …

Everything you should know about SOX | SOX Compliance guide

In 2002, the U.S. Congress passed the Sarbanes-Oxley Act, named after its co-sponsors, Senator Paul Sarbanes and Representative Michael Oxley.